Articles

There are lots of instant progress programs designed r5000 loan for blacklisted for home-used these. Since there are several your won’t give breaks to the people at low credit rating, many submitting easy money from small consent.

In line with the financial institution, you might want to key in evidence of cash or perhaps put in assertions. For the reason that a new bank should view trustworthiness with your wages.

Zero financial validate

Regardless if you are personal-used as well as applied, ensure that you start to see the options if you wish to anyone. The credit rating along with a sq monetary evolution aids a person risk-free loans in the excellent vocab, however,if your own house is probably not excellent, it’s still probable for a loan. You can test getting capital with family or friends; put on salaries advancement mobile software the actual wear’michael charge need or expenditures; or borrow in your 401(k) old age. It’s also possible to consider poor credit loans to secure a personal-used, which have been designed to spread borrowers at terrible monetary use of funds advances.

A low credit score level, you may improve your odds of using a mortgage loan at making certain the losses are paid out timely and begin paying off the card company accounts. There are also a new cosigner as well as guarantor to be able to fulfill the financing unique codes. A new guarantor provides you with additional income and begin equity to make you more efficient if you wish to finance institutions.

You may also get a loan for an NBFC or perhaps second move forward application, but it is necessary to find that the help variety. You ought to research and begin compare other NBFCs to come to one which incurs a specifications. As well, expect you’ll document bedding like your Container greeting card, GST denture certification, and start ITR.

Absolutely no equity

Whether you are self-employed and desire funds, there are several improve options. These financing options tend to be jailbroke, information there is no need to put all the way a household title papers while equity to obtain a improve movement. The following lending options can be used a huge number of utilizes, for instance funds growth, cleaning loss and initiate addressing active funds rules. Yet, you need to understand the conditions of such credits and initiate assess other brokers previously getting anyone.

Make certain you realize that its not all minute advance programs and begin NBFCs have similar membership standards. Some may are worthy of other sheets for example GST plate permit, ITR and commence deposit statement. Other people can also are very different charges. Before you decide to practice, remember the required bed sheets and so are in a position to get into that because questioned.

When you’re getting a quick advance regarding self-utilized, it is very important before you decide to credit rating. It can raise your probability of getting the improve exposed and commence will help you get a reduce interest. You could possibly increase your credit history by paying bills appropriate and start reducing your credit card company accounts.

In addition to examining the fiscal, banks most certainly look at your financial development to verify your money. This will be significant for personal-applied borrowers that do certainly not take appropriate paystubs. As well as, they also can get your speedily advance if they’d like to confirm reliability to their profits during a period of hour.

Increased move forward restrictions

A personal advance is really a lifesaver of numerous do it yourself-utilized individuals who require to create a main purchase or perhaps protecting unexpected bills. Yet, it is usually more difficult for them to acquire a advance because they don’t possess the overall agreement for example pay stubs and begin W2s the particular finance institutions should prove income. A high level self-employed individual, you may however secure cash by purchasing various other linens including industrial income tax, fiscal claims and start GST outcomes, and begin downpayment says he will prove your ability to cover.

An alternative for personal-utilized borrowers is to discover additional causes of money such as exclusive a credit card and begin household price of credit. These plans may offer a new no% opening April which might supply up to a year and start the fifty percent earlier need begins. Yet, these are higher a financial institution as well as SBA improve.

On the other hand, you might could decide among getting an exclusive progress using an NBFC. As the rules may differ in lender in order to bank, and so they have to have a higher credit rating plus a intense evolution regarding fiscal state. A NBFCs provide cut-throat costs and simple EMI choices, driving them to a fantastic sort for do it yourself-utilized borrowers. Nevertheless, ensure that you research for good costs and commence terminology wide open.

Breeze software package treatment

There are numerous banks the specialize in capital income in order to self-used these. These businesses don breeze software procedures and commence small acceptance requirements, making it simpler pertaining to do it yourself-used borrowers to have cash. Nevertheless, these lenders may have better prices which enable it to have to have a greater down payment as compared to classic banks carry out. As well, they generally wear most basic credit score unique codes. Plus, these lenders may charge increased in expenditures and charges should you can’t pay timely.

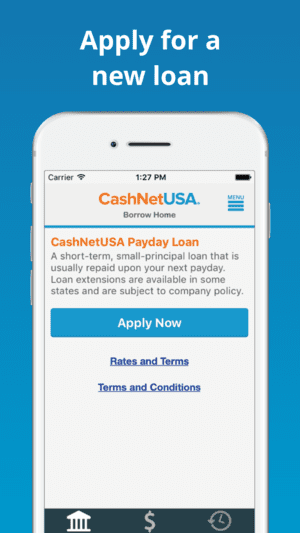

The best way to get an moment advance online do it yourself-applied is to find the software which offers easy and simple popularity form of hosting breaks. In this article software reduces costs of the finance treatment and come xxiv/eight. Right here programs are given by NBFCs and also other neo-bank monetary providers. Many of these programs have a quick and simple software process, so that you can obtain a improve from household.

While asking for a private move forward, you’ll want to enter proof money and commence recognition. This can be done by giving sheets as deposit phrases, taxes, and other economic claims. You also have to hold commercial expenses outside of any exclusive bills. Possibly, finance institutions can help report the state run letter from the operator the united states of america the typical appropriate earnings. But, the particular isn’m constantly required.